A friendly, step‑by‑step walkthrough designed for Bozeman‑based entrepreneurs and anyone who wants a smoother bookkeeping experience.

Why QuickBooks Online? What Makes It a Smart Choice

When you’re a small business owner, your time is valuable. You’re juggling inventory, customer relationships, marketing, and, inevitably, numbers. QuickBooks Online (QBO) is designed to let you focus on growing your business, not getting buried in spreadsheets. Here are a few reasons why it’s a great fit for small companies:

- Cloud‑based access: view your books from a laptop, tablet, or smartphone, anywhere you have internet.

- Automation: bank feeds, invoicing, payroll, tax calculations—most of it happens automatically.

- Scalability: start with the Essentials plan and add users or features as you expand.

- Integration: connect with hundreds of third‑party apps—e‑commerce, point‑of‑sale, CRM, and more.

- Support: a strong knowledge base, community forums, and dedicated partners in Montana ready to help.

Getting Your QuickBooks Online Account Up and Running

The first step is simple: create an account. It’s free to try, so feel free to experiment without commitment. Here’s a quick walkthrough:

1. Visit the QuickBooks Online website and click Start free trial. You’ll need to enter your email, create a password, and answer a few questions about your business.

2. Choose the plan that fits your current needs. For most new small businesses, the Essentials plan works well—three users, invoicing, expense tracking, and basic reporting.

3. Confirm your email and log in. You’ll land on the dashboard, which feels like a mini‑command center for your finances.

Building Your Chart of Accounts: The Foundation of Accurate Bookkeeping

The chart of accounts is like a map that tells QBO how to classify every dollar that comes in and goes out. Setting it up right the first time saves headaches later. Below is a practical example for a typical retail shop in Bozeman.

| Account Type | Example Account | What It Tracks |

|---|---|---|

| Income | Product Sales | Revenue from selling goods. |

| Expense | Rent | Monthly lease payments for your storefront. |

| Expense | Utilities | Electricity, water, internet, and other utilities. |

| Asset | Inventory | Cost of goods available for sale. |

| Liability | Accounts Payable | Money owed to suppliers. |

| Equity | Owner’s Equity | The owner's share in the business. |

When you set up each account, be consistent with naming conventions. For instance, always start income accounts with “Income –” and expenses with “Expense –”. This small habit helps when you generate reports or audit your books later.

Connecting Your Bank and Credit Card Accounts

One of QBO’s biggest strengths is its bank‑feed integration. By linking your accounts, you automatically import transactions, saving you hours of manual entry.

- From the dashboard, click Banking in the left sidebar.

- Press Connect account and search for your bank. If you’re in Bozeman, you might use Wells Fargo, Chase, or the local Bank of Montana.

- Enter your online banking credentials. QuickBooks will pull recent transactions.

- Assign each transaction to an account in your chart. You can create rules to automate this for future imports.

Tip: After your first week, revisit the rules you created to fine‑tune the accuracy. The more you match categories correctly, the more accurate your reports will be.

Creating and Sending Invoices that Get Paid Faster

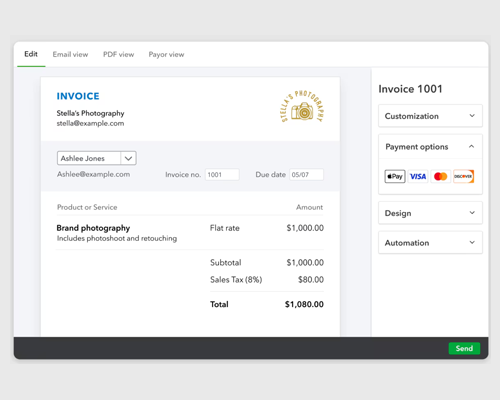

QBO’s invoicing features are straightforward, but they can feel powerful once you start using them. Here’s a guide to creating a professional invoice.

1. In the left menu, click Sales then Invoices.

2. Press New invoice. Fill in customer information, item details, and terms (e.g., Net 30).

3. Add a custom message if you want a personal touch—quickbooks automatically inserts your business address and logo.

4. Click Save and send. Your invoice will be emailed directly from QBO.

5. Track status: the invoice will show “Pending”, “Paid”, or “Past Due”. QBO can even send automatic reminders.

Expense Tracking: From Receipt to Report

Every purchase matters, whether it’s a coffee with a client or a bulk order of merchandise. QBO makes expense tracking effortless, especially with the mobile app.

Using the Receipt Capture feature:

- Open the QuickBooks app on your phone.

- Take a photo of the receipt.

- QuickBooks reads the data, matches it to a bank transaction, and assigns it to the appropriate account.

- Review and confirm. Adjust if needed.

When you’re in the desktop view, you can also drag and drop your receipts into the Banking tab to auto‑match. If a match isn’t found, QBO suggests the best fit based on the vendor name and amount.

Generating Reports that Reveal Your Business’s Health

Reports are the heart of business insight. QBO offers a variety of standard reports, but customizing them can give you a sharper picture.

| Report | What It Shows | Why It Matters |

|---|---|---|

| Profit & Loss (P&L) | Revenue vs. expenses over a period. | Shows net profit or loss. |

| Balance Sheet | Assets, liabilities, equity at a point in time. | Highlights financial stability. |

| Cash Flow Statement | Inflow and outflow of cash. | Identifies liquidity issues. |

| Accounts Receivable Aging | Outstanding invoices by age. | Helps manage collections. |

| Expense by Category | Detailed expense breakdown. | Spotlights cost centers. |

To access these, go to Reports in the left menu, then search for the name. Use the Customize button to filter by date, add a graph, or include more accounts.

Payroll: Making Sure Your Team Gets Paid on Time

If you have employees, QBO’s payroll module can help you stay compliant. While the basic payroll feature is free with the Essentials plan, you may want to upgrade for tax filings and additional users.

Setting up payroll involves:

- Adding employee details: name, address, Social Security, tax filing status.

- Choosing a pay schedule: weekly, bi‑weekly, monthly.

- Configuring pay rates and deductions (health, retirement, taxes).

- Running the payroll run—QBO calculates taxes automatically.

After each run, you can print pay stubs, file with state and federal agencies, and automatically deposit wages into a bank account.

Tax Season Made Simple: Filing Your Business Taxes with QBO

Because QBO tracks every transaction, your tax data is ready when the filing season starts. You can export a Schedule C for sole proprietors or a Form 1120S for S‑Corporations directly from the reports section.

QuickBooks also partners with TaxAct and TurboTax for seamless filing. The process typically involves:

- Running the Profit & Loss report for the fiscal year.

- Exporting the PDF or CSV file.

- Uploading to the tax software, which maps the numbers to the correct tax form.

- Reviewing the pre‑filled amounts and submitting.

Don’t forget to keep your records for at least seven years—QBO retains all data, so you can always retrieve past statements if needed.

Best Practices: Keeping Your QuickBooks Data Clean and Accurate

Even with automation, it’s essential to maintain a disciplined bookkeeping routine:

- Regular Reconciliations: At least once a month, match your bank statements to QBO entries.

- Backup Your Data: Although QBO is cloud‑based, exporting a backup PDF each quarter is a good safety net.

- Use Class Tracking if you run multiple locations or product lines—this gives you granular insights.

- Schedule a Quarterly Review with a local QuickBooks Gold Partner. A professional audit can catch hidden issues.

Common Pitfalls to Avoid When Using QuickBooks Online

Below are a few missteps that many new users encounter:

- Over‑categorizing transactions—keep your chart of accounts streamlined.

- Forgetting to match bank transactions—this can lead to double‑counting.

- Ignoring overdue invoices—use the auto‑reminder feature and keep an eye on the aging report.

- Relying on spreadsheets for cash flow—trust the built‑in cash flow statement.

- Missing payroll taxes—use QBO’s built‑in tax calculations and file automatically.

Where to Find Help: Community, Resources, and Partners in Bozeman

QuickBooks Online offers a robust support ecosystem:

- QuickBooks Help Center: searchable knowledge base, how‑to videos.

- QuickBooks Community: forums where you can ask questions and share experiences.

- QuickBooks Gold Partners: certified experts who can tailor solutions to your specific needs. In Bozeman, our local partners offer personalized onboarding, training sessions, and ongoing support.

- Local Meetups: quarterly networking events for Montana small business owners—great for exchanging tips and building relationships.

Wrapping It Up: Your Path Forward

Setting up QuickBooks Online is just the beginning. The real value lies in the ongoing use of its features: regular bank feed reviews, consistent invoicing, timely expense capture, and diligent reporting. By following the steps in this guide, you’ll build a reliable financial foundation that lets you focus on what you love—growing your business.

Remember, you’re not alone. Whether you need help configuring your chart of accounts or a deep dive into tax filing, our team of QuickBooks Gold Partners in Bozeman is ready to guide you every step of the way. Let’s keep your books clean, your cash flowing, and your future bright.