The Hidden Costs of Poor Expense Tracking: Why Contractors Can’t Afford to Ignore Mileage and Receipts

Between running jobs, managing crews, and keeping clients happy, it's no surprise that many contractors and construction business owners let things like mileage tracking and receipt management slide. But here’s the reality — failing to stay on top of these small, everyday expenses can lead to big financial losses over time.

Lost tax deductions, unclaimed reimbursements, and inaccurate project costing are just a few of the ways this oversight adds up. And in a business where every dollar counts, that can be the difference between a decent year and a tough one.

Why Expense and Mileage Tracking Actually Matters

Most contractors are constantly on the move — visiting job sites, picking up supplies, meeting clients. Every mile you drive and every dollar you spend on materials, tools, fuel, or even parking is a potential tax write-off. But if you’re not logging those miles or saving those receipts, you’re giving that money right back to the IRS.

Most contractors are constantly on the move — visiting job sites, picking up supplies, meeting clients. Every mile you drive and every dollar you spend on materials, tools, fuel, or even parking is a potential tax write-off. But if you’re not logging those miles or saving those receipts, you’re giving that money right back to the IRS.

We’ve seen small construction businesses miss out on thousands in deductions simply because the tracking process felt like too much of a hassle. And who can blame them? When you're juggling project timelines and crew schedules, scanning receipts and recording mileage probably isn’t top of mind.

The Silent Impact on Your Bottom Line

Expense tracking isn’t just about tax season — though that’s a big one. It also affects how accurately you price jobs. If you’re not capturing all the little out-of-pocket costs during a project, you’re underestimating what it actually costs to do the work. That leads to underbidding — and smaller profit margins.

And if you’re paying for things out of pocket and forgetting to record them? That’s money gone for good.

How QuickBooks Makes Tracking Easy (Without Slowing You Down)

The good news? You don’t need to carry a clipboard around or manually enter every receipt into a spreadsheet. QuickBooks has tools built specifically for busy contractors who need to keep things simple:

- Automatic Mileage Tracking: Use the QuickBooks mobile app to track your miles automatically in the background — no more guesswork.

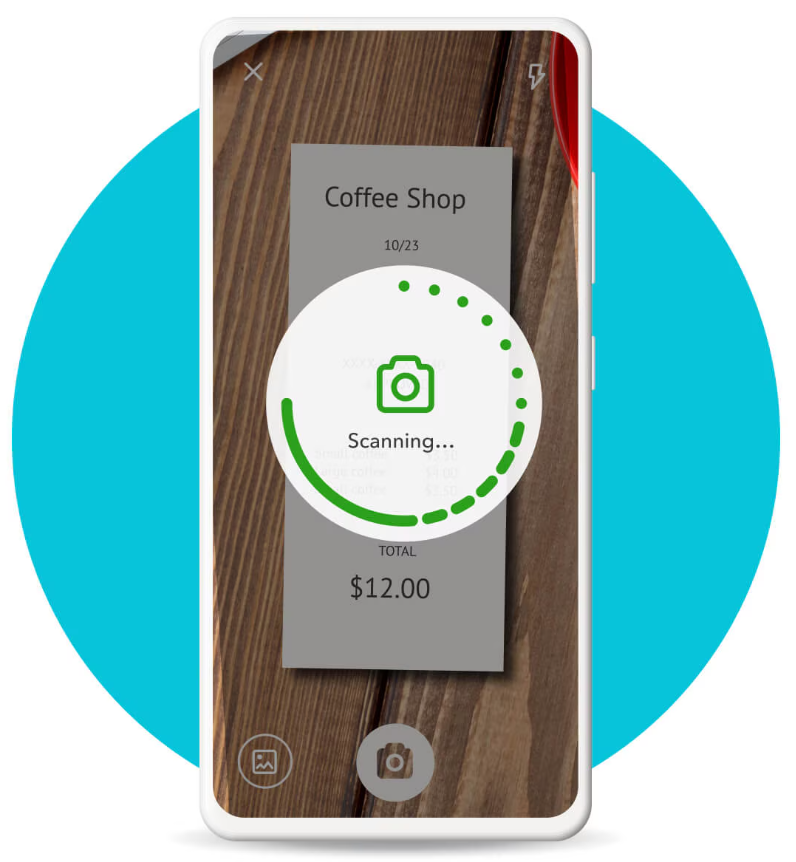

- Receipt Capture: Snap a photo of a receipt and QuickBooks pulls in the vendor, date, and amount. Done in seconds.

- Expense Categorization: Tag expenses to specific jobs or categories, so you always know where your money is going.

- Real-Time Reports: Instantly see your project costs, tax deductions, and cash flow — without waiting for month-end.

These tools are designed with small business owners in mind — no complicated setup, no steep learning curve. Just practical tools that help you stay organized and save money without adding more to your plate.

How We Can Help as a QuickBooks Gold Partner

At our firm, we specialize in helping contractors and small construction companies get the most out of QuickBooks. As a QuickBooks Gold Partner, we don’t just set you up and walk away — we partner with you to simplify your financial operations, including:

At our firm, we specialize in helping contractors and small construction companies get the most out of QuickBooks. As a QuickBooks Gold Partner, we don’t just set you up and walk away — we partner with you to simplify your financial operations, including:

- Setting up mileage tracking and receipt capture the right way

- Cleaning up messy books and ensuring expenses are categorized properly

- Training your team to use QuickBooks efficiently, whether in the office or out in the field

- Helping you claim every deduction you’re legally entitled to at tax time

You focus on building. We’ll handle the numbers — and make sure you’re not leaving money on the table.

Final Thoughts

You’re already doing the work. The materials get bought. The miles get driven. The expenses happen. The only question is: are you tracking them in a way that benefits your business?

With the right tools and a trusted partner, it’s easier than you think to turn those everyday costs into meaningful savings and smarter decision-making.

Ready to stop missing out on tax savings and take control of your business expenses? Reach out today for a free consultation. We’ll help you get your systems in place and show you how QuickBooks can make expense and mileage tracking a breeze.